We’ve got your car insurance needs covered:

- Our Dynamite Deductible® Endorsement. A reducing deductible endorsement. Your deductible for Comprehensive or Collision losses may be lowered semi-annual policy renewal or at annual policy renewal (limited by carrier & as permitted by state law).

- One Household, One Policy for all Vehicles. This means that your Auto policies are captured in one easy-to-read bill, so you don’t have to worry about different effective dates, renewals or multiple bills.

- Uninsured/Underinsured Motorists. Coverage that protects you financially if you’re in an accident with someone who’s at fault and either has no insurance or insufficient insurance.

- Bodily Injury and Property Damage. This covers your legal liability for a covered accident that involves injury to another person or damage to someone’s property, up to the limit of liability you select.

- Rental Reimbursement. If you rent a car after you have a covered loss on your automobile, the carrier will put the policy limits (like $50 a day) back in your pocket for up to the policy limits (usually 30 days).

- Medical Payments. Hopefully never needed, but always important with auto insurance, this coverage pays for the necessary medical care you receive as a result of an auto accident.

- Towing and Roadside Service. If your car needs towing or assistance on the road, we have carriers that will cover the cost for you. This covers you for each disablement on a covered vehicle and may be subject to a maximum limit per policy depending on the carrier of choice.

- Loan/Lease Coverage. This will pay the difference between what you owe on your vehicle and what your insurance pays, if your vehicle is declared a total loss after an accident or is stolen and not recovered, minus your comprehensive or collision deductible.

Give us a call at (616) 406 0645 or request a quote online.

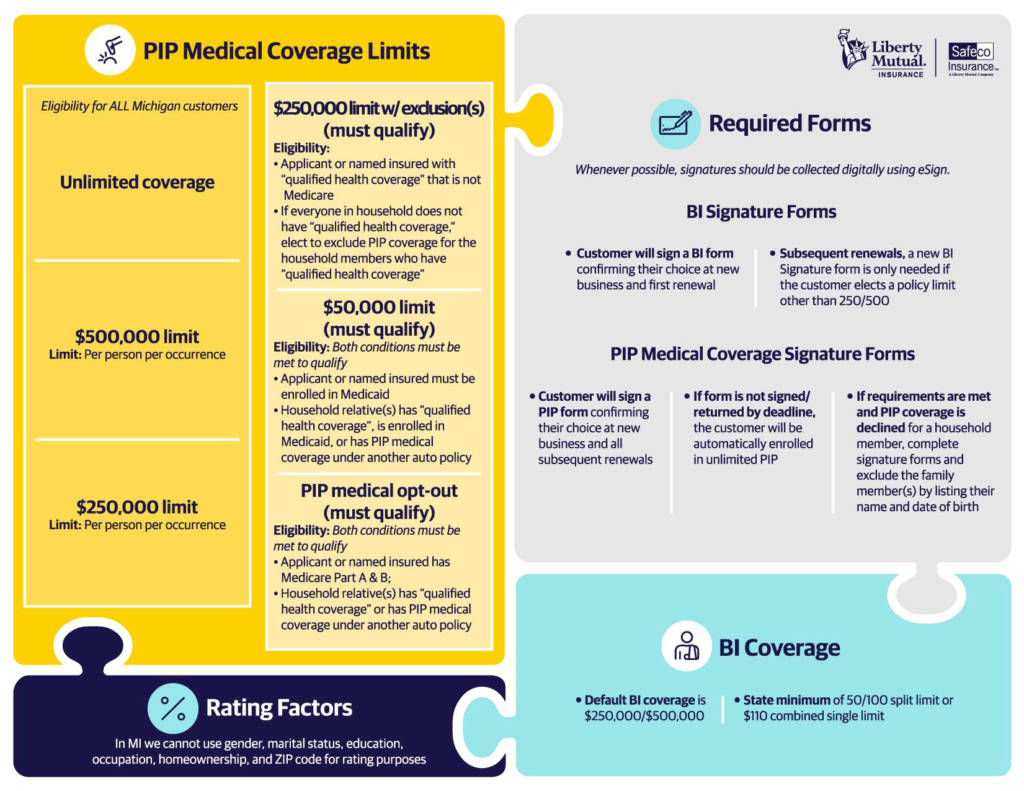

*On July 1, 2020 Michigan’s auto insurance laws are changing. Do you know how the new auto insurance laws affect your coverage?